Nashville, TN – The Pennsylvania Bankers Association has announced the election of John M. Hayes, Chief Executive Officer and Director for New Tripoli Bank, to its Board of Directors, effective May 17, 2024. Mr. Hayes joins a board of 27 member-elected representatives from banks throughout the Commonwealth who are responsible for determining the Association’s policies and governing principles.

Mr. Hayes is the seventh Chief Executive Officer of New Tripoli Bank, and he was recently appointed as the newest member of its Board of Directors. He also serves on the board of New Tripoli Bancorp, Inc., the holding company for New Tripoli Bank. Mr. Hayes has over 30 years of banking and financial services experience and is active in his local community as well, serving as Chair of the Board of Governors of the Lehigh Northampton Airport Authority. He has previously served as Chair of the Board of Governors of the Lehigh Valley Chamber of Commerce and Housing Association & Development Corporation.

Mr. Hayes acknowledged, “I am honored to have been elected to the Pennsylvania Bankers Association Board, representing the industry’s interests and their mission to advocate for banks throughout the state. PA Bankers has always supported community banks like New Tripoli Bank and I am proud to offer my time and experience to furthering our mutual goals.”

Willard Snyder, New Tripoli Bank’s Chairman Emeritus, joined the Bank in 1960 as a clerk. Rising through the ranks, he became Chief Executive Officer in 1981 and Board Chair in 1994. His long career with the Bank provided Willard with a wealth of stories, experience, and knowledge about the Bank and the industry. He was kind enough to share his experiences with us on a recent tour of the original bank location, which is now the Lynn-Heidelberg Historical Society in New Tripoli, PA.

For National Museum Day, we invite you to listen to Willard Snyder's reflections on his time with New Tripoli Bank, his knowledge of old banking technology, and the stories he told us about New Tripoli Bank's rich history. We hope you enjoy this video.

To learn more about the Lynn-Heidelberg Historical Society, visit their website at https://www.lynnheidelberg.org/

Click the video to view

New Tripoli Bank announced the appointment of John M. Hayes as a member of its Board of Directors effective December 19, 2023. He was also named to the board of directors of New Tripoli Bancorp, Inc., holding company for New Tripoli Bank.

Mr. Hayes is Chief Executive Officer of New Tripoli Bank. He joined the bank in February 2016 as Senior Vice President and Chief Lending Officer and was promoted to Executive Vice President in December 2016. He has over 30 years of banking and financial services experience and is active in the community as well, serving as Chair of the Board of Governors of the Lehigh Northampton Airport Authority, and past chair of the Board of Governors of the Lehigh Valley Chamber of Commerce and Housing Association & Development Corporation.

David R. Hunsicker, Chair and President, stated, “We are proud to welcome John to the Bank’s Board of Directors. He has demonstrated strong leadership and decision-making skills and has worked hard to prepare the bank for the future. Additionally, he has a strong customer and community focus which is essential for New Tripoli Bank to continue to grow. He lives and breathes our slogan, “Because People are More Valuable than Money.”

Mr. Hayes acknowledged, “I am proud and pleased to become a part of the Bancorp and Bank boards and look forward to continuing to work together to take the organization forward. Having lived and worked in the Lehigh Valley my entire life, community is a vital component which drives many decisions in our organization.”

New Tripoli Bank’s Board of Directors has approved the promotion of Paxton Werley, Network Specialist, to Assistant Vice President.

Werley has been an employee of the Bank since 2019, when he was hired as a Data Operations Specialist. His current role focuses on developing and maintaining the Bank’s IT systems, policies, and infrastructure.

“Paxton has shown himself to be a motivated and capable individual who reflects the values we encourage at the Bank,” said John M. Hayes, Chief Executive Officer of New Tripoli Bank, commenting on the Board’s decision. “This promotion reflects the level of responsibility he’s taken on in recent months and our great expectations for his future with the Bank.”

When asked about his promotion, Werley replied, “I’d like to express my sincere gratitude to all of New Tripoli Bank’s leadership and staff for allowing me to learn from them. I look forward to continuing my career here and being part of the future of the Bank.”

New Tripoli Bank employees and their families were in the stands for Wednesday's Iron Pigs win over the visiting Buffalo Bisons to root for our home team. This yearly outing gives everyone the chance to unwind with coworkers and family while enjoying our national pastime.

We've been around for over 110 years, so it's no surprise that history is important to us. That's why for National Museum Day we wanted to highlight an organization dedicated to preserving history in our community.

The Weisenberg/Lowhill Township Historical Society was organized in 2003 to help curate cultural artifacts and celebrate the heritage of Weisenberg and Lowhill Townships in the Lehigh Valley. We sat down with members of the historical society to introduce you to their members, their facilities, and what they do to preserve our history.

You can learn more about events at the historical society by visiting their website at http://www.weisenberglowhill.org/

New Tripoli Bank offers its most heartfelt congratulations to David R. Hunsicker, President and Chairman, for 50 years of employment with the Bank.

Hunsicker was hired by then- CEO Willard Snyder in 1973 as a teller where he learned the daily operations of the Bank, and then later to positions of increasing responsibility. "Dave did exceptionally well and advanced through various positions and roles within the Bank," Willard reflected. "He was quick to grasp all the challenges I gave him, of which there were many."

"Throughout my career, Willard was a great mentor," Hunsicker said of the former President/CEO, "He encouraged me to attend State and National banking association events, which gave me the opportunity to meet and learn from other successful bankers."

In 1982, Hunsicker was promoted to Vice President and expanded his purview to include commercial lending. He was then promoted to Executive Vice President in 1987. On January 1st, 1996, he was selected to succeed Willard Snyder as Chief Executive Officer of New Tripoli Bank, becoming President and Director of the Board that December. He then assumed the additional role of Chair of the Board in 2011.

Under Hunsicker's leadership, New Tripoli Bank continued to establish itself as the premier community bank in the Lehigh Valley, weathering several financial crises and opening two additional bank branches in Orefield and Upper Milford Township.

"On behalf of the Board of Directors, we thank Dave for his decades of service," said Larry Oswald, Vice Chairman of New Tripoli Bank's Board of Directors. "New Tripoli Bank would not be the Bank it is today were it not for Dave's vision, leadership, and guidance. We have tackled many challenges over this time and Dave's steady hand at the helm made it work, and work well. Thanks Dave, and best wishes as you continue forward!"

John M. Hayes, who succeeded Hunsicker as CEO in 2022, commented as well, "Dave is the best community banker I have ever had the privilege of working with. His knowledge of the industry and the communities we serve is encyclopedic. He has accomplished great things at New Tripoli Bank, and we can't thank him enough for the amazing work he has done."

Asked about the bank's future, Hunsicker said, "I have always believed in our motto: 'People are More Valuable Than Money.' This is our competitive advantage and will continue to be going forward. As long as we continue to provide the best in personal service, we have a great advantage over other financial institutions."

In addition to his work for New Tripoli Bank, Hunsicker has served on the boards and regional committees of numerous trade associations, including the PA Bankers Association, PA Association of Community Bankers, Atlantic Community Bankers Bank, and the Independent Community Bankers of America. In addition, in 2013 he was appointed to the board of the Federal Reserve Bank of Philadelphia where he served for six years, including four years as Chair of the Audit Committee. Hunsicker considers this a highlight of his career. "It allowed me to work with different Federal Reserve Banks across the country," he said, "I learned from other industry leaders and what makes the U.S. economy special."

Reflecting on his career path, Hunsicker said, "When I joined New Tripoli Bank I thought, if I worked hard, someday I may have a chance to be CEO. I always enjoyed finance and banking; both areas were perfect matches for me. New Tripoli Bank allowed me to make my community a better place; I have had the best job ever, and I will always be thankful for the opportunity."

New Tripoli Bank donated $2,500 to the Parkland CARES Food Pantry as a show of support for their mission to feed and serve members of our community affected by and suffering from hunger.

“Parkland CARES is extremely grateful to New Tripoli Bank for their generous donation,” said Katrina Sundstrom, Executive Director for the Food Pantry, “The funds will be used to purchase Snack Pack items to feed the over 350 Parkland students who receive the bags each month.”

Parkland CARES opened its doors for the first time in 2019 to just 12 families and by the end of the year had grown to supporting over 100 households. When the COVID pandemic hit in 2020, the pantry switched to a contactless drive-thru model for distribution. Parkland CARES works closely with Second Harvest Food Bank, Orchard Hills Church, and many other community partners to fulfill its mission to feed the less fortunate in our community.

“The health and well-being of families is important to New Tripoli Bank,” said John M. Hayes, CEO of the Bank, “We see the amazing work that Katrina and the rest of the Parkland CARES team are doing to provide support for those who need help. We are glad we can help them continue to meet our community’s needs.”

Pictured from left to right: John M. Hayes, New Tripoli Bank CEO, Katrina Sundstrom, Parkland CARES Executive Director, Michele Hunsicker, New Tripoli Bank Executive VP & CFO

Pictured from left to right: John M. Hayes, New Tripoli Bank CEO, Katrina Sundstrom, Parkland CARES Executive Director, Michele Hunsicker, New Tripoli Bank Executive VP & CFO

New Tripoli Bank donated $10,500 to the Cetronia Ambulance Corps to show its support for their organization’s mission to provide emergency medical services, transportation, and community health resources to the Lehigh Valley region.

“New Tripoli Bank is committed to making sure our local emergency services teams have the funds they need to maintain and upgrade their equipment,” said John M. Hayes, CEO of New Tripoli Bank.

Cetronia Ambulance Corps is one of the largest providers of ambulance services in Eastern Pennsylvania, employing 135 full- and part-time career associates, 20 active volunteers and boasting a total fleet of 41 vehicles. As the regional leader in EMS, Cetronia Ambulance Corps fields over 45,000 calls annually, covering an emergency service area that spans across 130 square miles, and a non-emergency coverage area that encompasses five counties. They also provide emergency response training and education programs for groups, businesses, and individuals.

“We are so thankful to be serving this wonderful community that has shown us such great support for the lifesaving work we have been doing for the past 68 years. We look forward to the future and the advances that we can make because of our generous donors,” said Robert F. Mateff Sr., CEO of Cetronia Ambulance Corps, “New Tripoli Bank has been an excellent supporter of EMS over the years, and we can't thank them enough for their community-minded vision.”

Pictured from left to right: John M. Hayes, New Tripoli Bank CEO, Robert F. Mateff Sr., Cetronia Ambulance Corps CEO, Kim Blichar, Cetronia Ambulance Corps Director of Marketing & Public Relations, Michele Hunsicker, New Tripoli Bank CFO

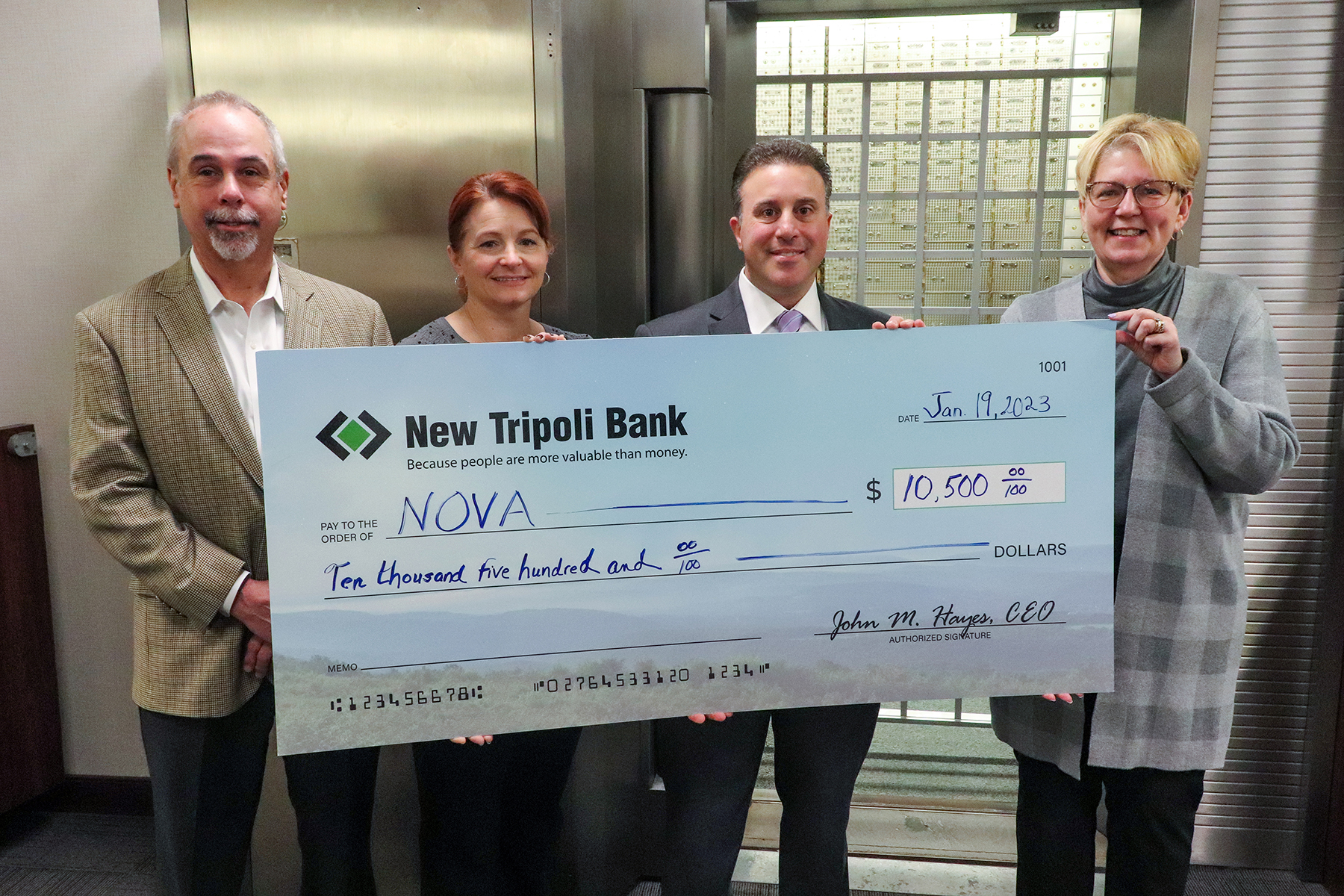

New Tripoli Bank donated $10,500 to the Northern Valley EMS, Inc. (NOVA) in recognition of the important role the organization serves in protecting the health and safety of the community.

“This check shows our Bank’s commitment to keeping our community safe and our faith in the service NOVA’s volunteers provide to the Lehigh Valley,” said John M. Hayes, CEO of New Tripoli Bank. Hayes was joined by Michele Hunsicker, Chief Financial Officer for the Bank, to present the check to Jason Breidinger, NOVA Board Trustee, and Kristie Wentling, Executive Director of NOVA. The Bank has shown its support for NOVA for several years through annual donations to their organization.

NOVA provides non-profit emergency medical services to North Whitehall, Washington, Heidelberg, and portions of Lowhill Townships and the Boroughs of Slatington and Walnutport, serving more than 45,000 residents of the Lehigh Valley. They operate year-round, 24-hour ambulance services as well as providing emergency response training and education programs to volunteers in the community.

Pictured from left to right: John M. Hayes, New Tripoli Bank CEO, Kristie Wentling, NOVA Executive Director, Jason Breidinger, NOVA Board Trustee, Michele Hunsicker, New Tripoli Bank CFO

Next Page »

Log In

Log In

Log into Online Banking

Log into Online Banking