The start of each new year is a time for us to reflect on the past year and plan for the next. 2022 was a challenging year for a lot of reasons, not the least of which was record-high inflation that had plenty of people tightening their budgets. As we head into 2023, I'd like to offer some tips to help you establish and maintain good credit so you can enjoy a brighter financial future.

Open a Checking Account

While a checking account can't help you improve your credit score, it does help you balance your budget while you're establishing a credit history. By making credit card and loan payments with your checking account, you will see all of your monthly transactions on a single bank statement rather than having to compare several different statements in order to get a full view of your financial situation.

Another benefit of checking accounts is that most come with a debit card. Using a debit card along with your credit card is safer than paying with cash, since banks offer fraud protection and card controls to help prevent negative impact to your credit if your card is lost or stolen. Make sure to monitor your credit and bank statements regularly, so you can correct any errors and detect signs of potential identity theft.

Automate Bill Payments

One of the easiest ways to damage your credit is to fall behind on loan or credit card payments. Thankfully, most banks (New Tripoli Bank included) offer automatic bill pay through their online banking platforms to ensure that your monthly bills are paid.

An emergency fund is helpful for staying ahead of your bill payments. A good rule of thumb is to set aside enough money to pay for six months of living expenses so that, in the event of an emergency, you can absorb unexpected expenses and avoid penalties for late payments. Thankfully, most banks' online banking platforms allow you to set up automatic, recurring transfers between accounts, so you can set aside a portion of each paycheck for a rainy day into a dedicated emergency savings account.

Show Stability in Your Credit Use

As you work to maintain your credit, you should seek to develop a good mix of credit—for example, paying down a mortgage loan plus credit card payments—to demonstrate that you can manage different types of credit, which can improve your credit score. It is also better to pay down your credit gradually instead of immediately paying off your debt all at once, as it shows you are capable of making payments on time.

If you are planning to use credit for a large purchase, you should adjust your credit usage leading up to the purchase. For at least three to six months prior to your purchase, you should focus on paying down existing debt and avoid incurring new debt.

By establishing these spending and saving habits early, you'll be able to make your money work for you so you can speed up your recovery from temporary financial roadblocks and remain financially healthy. If you are concerned about your financial wellness, New Tripoli Bank offers checking, savings, and lending options to help you navigate pivotal financial milestones and plan for your financial future. Reach out to one of our friendly community bankers who can help steer you in the right direction for 2023.

Kate Hart-Zayaitz is New Tripoli Bank's Chief Lending Officer and Senior Vice President. Kate has spent many years working for various community banks in our area. She was born and raised in Emmaus and has been involved with multiple banking and economic organizations throughout the Lehigh Valley.

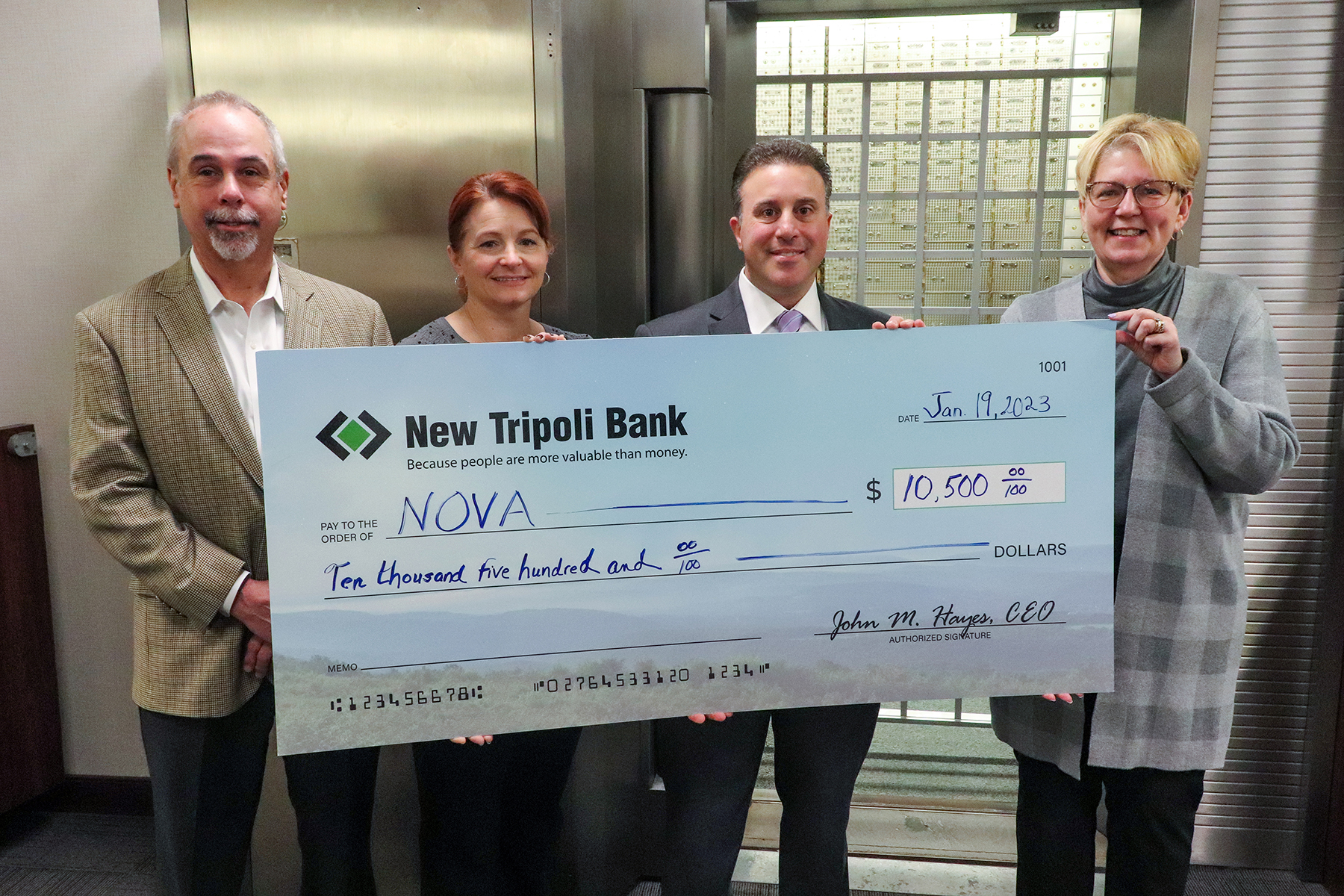

New Tripoli Bank donated $10,500 to the Northern Valley EMS, Inc. (NOVA) in recognition of the important role the organization serves in protecting the health and safety of the community.

“This check shows our Bank’s commitment to keeping our community safe and our faith in the service NOVA’s volunteers provide to the Lehigh Valley,” said John M. Hayes, CEO of New Tripoli Bank. Hayes was joined by Michele Hunsicker, Chief Financial Officer for the Bank, to present the check to Jason Breidinger, NOVA Board Trustee, and Kristie Wentling, Executive Director of NOVA. The Bank has shown its support for NOVA for several years through annual donations to their organization.

NOVA provides non-profit emergency medical services to North Whitehall, Washington, Heidelberg, and portions of Lowhill Townships and the Boroughs of Slatington and Walnutport, serving more than 45,000 residents of the Lehigh Valley. They operate year-round, 24-hour ambulance services as well as providing emergency response training and education programs to volunteers in the community.

Pictured from left to right: John M. Hayes, New Tripoli Bank CEO, Kristie Wentling, NOVA Executive Director, Jason Breidinger, NOVA Board Trustee, Michele Hunsicker, New Tripoli Bank CFO

New Tripoli Bank's mobile banking platform will be receiving an update targeted for a release date of January 18th. Here is a list of changes you should be aware of.

- You may be required to enroll for Fast Balances in order to use the balances link on the bottom-left of the sign-in page. In order to enroll in Fast Balances, go to "Manage Balances" in the Service Center. Fast Balances allow you to see your current balance for the accounts you enable without needing to enter your User ID or password.

- This update will require you to re-establish any FingerPrint/FaceID Biometrics to login using that feature. When enabled, this feature allows you to log in securely without entering your user ID and password.

- The new "Forgot User ID" feature will allow you to retrieve your user ID if you are unable to remember it by following a few steps, after which an email will be sent to your email address on file with your user ID.

New Tripoli Bank’s Board of Directors has approved the promotion of Andrea Harris, Bank Security Act (BSA) and Security Officer, Timothy Trach, Loan Operations Manager, and Matt Koncz, Controller and Certified Public Accountant, each to the position of Assistant Vice President.

“Each one of these employees has shown excellent leadership skills and dedication to the bank,” said John M. Hayes, New Tripoli Bank’s CEO. “The Board of Directors and I thought it was time to recognize the important role each one of them plays in our organization.”

Andrea Harris joined the bank in 2011 and has worked as a Community Banker and Accounting Specialist prior to managing the bank’s BSA/Security Department. Timothy Trach joined the bank in 2016 as a Credit Analyst, then moved to the position of Mortgage Loan Officer and then was promoted to Manager of Loan Operations. Matt Koncz was hired in 2019 to join the bank’s Accounting Department as the Controller.

Pictured from left to right: Matt Koncz, Andrea Harris, Tim Trach

Pictured from left to right: Matt Koncz, Andrea Harris, Tim Trach

Our condolences go out to the men and women of the New Tripoli Fire Company. We are shocked and saddened by the news that two firefighters, Assistant Chief Zachary Paris and Marvin Gruber, died yesterday while trying to save people trapped in a burning house in West Penn Township.

These men knew the risks they took every time the alarm rang, and they still answered the call. We are so very fortunate to have such brave men and women willing to put their lives on the line to protect our community.

Please join the bank, its Directors and employees, in sending deepest sympathies and heartfelt love for the lost, their families, and the other members of the Fire Company and their families in this difficult time.

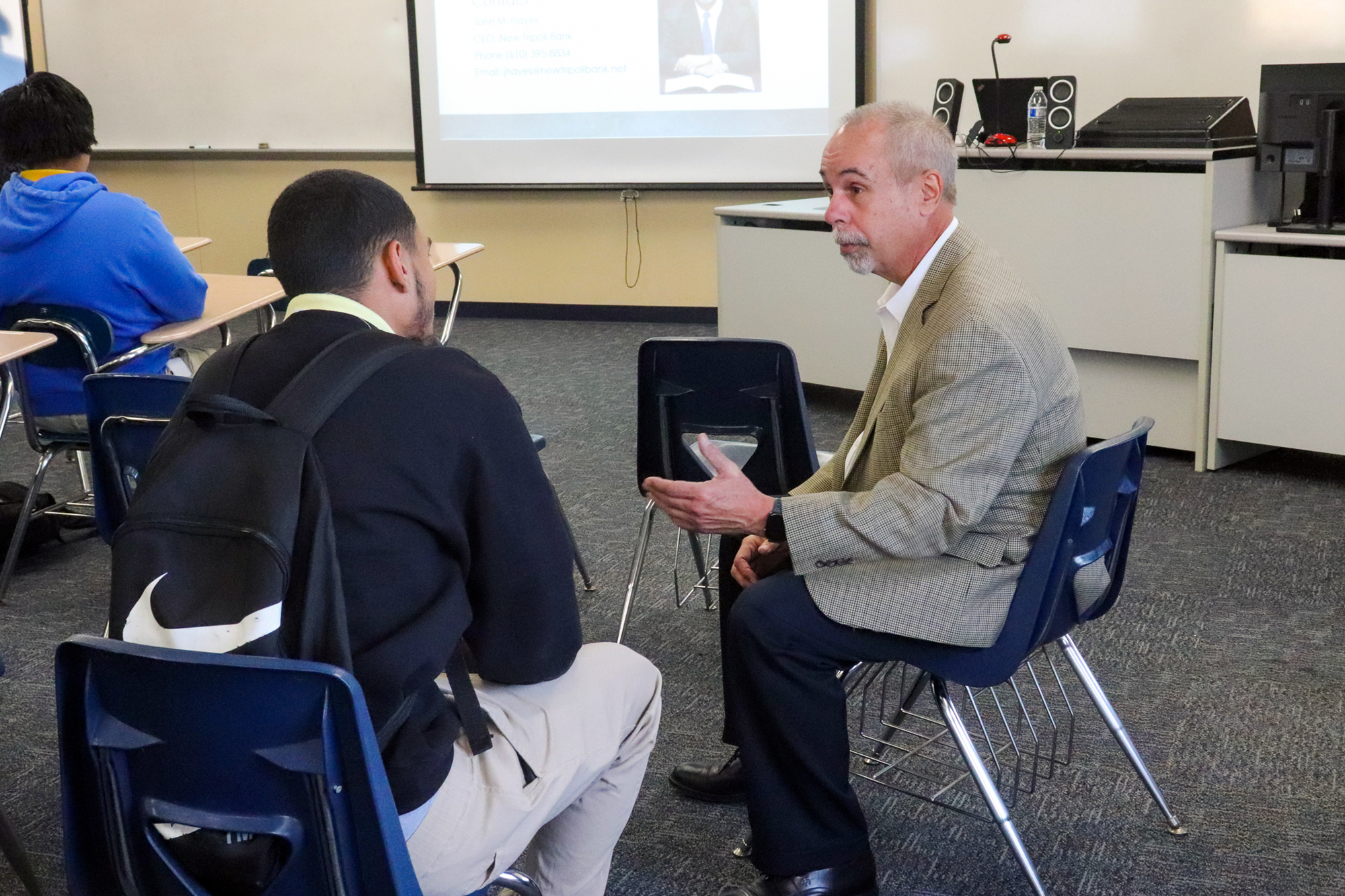

On Tuesday, November 15, 2022, John M. Hayes, CEO of New Tripoli Bank, presented a lecture on financial literacy at William Allen High School in Allentown. This talk is part of the bank’s initiative to promote financial literacy to young people in the Lehigh Valley.

A total of 225 high school students attended Mr. Hayes’ lectures throughout the day. John discussed several financial literacy topics including the different types of bank accounts, interest rates and other banking terms, the various types of fraud and scams and how to recognize them, and tips for students to better prepare for job interviews. Students in attendance posed questions that Mr. Hayes was more than happy to answer, pulling from decades of banking experience to teach students about financial literacy.

“New Tripoli Bank has a long history of helping students understand banking, the job market, and why these issues are crucial for their future,” Hayes said. “In addition, fraud is here to stay, and students need the tools to protect themselves and their families.”

New Tripoli Bank prepared several handouts for the students to take with them following the presentation. The bank also provided promotional items that the high school faculty raffled off to students who attended the lectures. New Tripoli Bank thanks William Allen High School’s teachers for approaching the bank with the opportunity to help empower their students to make good financial choices in their futures.

Planning to spread some cheer this holiday season? Extend that cheer to your community during the holidays by purchasing one-of-a-kind creations from local small businesses in the Lehigh Valley. By doing so, you’ll be giving a gift that keeps on giving—local economic prosperity.

Did you know that for every $100 you spend at locally owned businesses, $48 out of every $100 is returned to the local economy, compared to just $14 when you shop at a national chain? Or were you aware of the country’s 32.5 million small businesses that create 62% of net new U.S. jobs annually? By shopping locally, you’re not only putting your hard-earned dollars to work in your community; you’re providing the fuel that powers our national economy.

Independent, community-serving businesses typically consume less land, carry more locally made products, and create less traffic and air pollution, so shopping locally is good for the environment too. Moreover, locally sourced goods and services like those found in Lehigh Valley are often crafted by local artisans and are exclusive to our region, making for memorable gift-giving during the holidays and beyond.

If you prefer your gifts without a shiny bow, gift an “experience” of tickets to an outside concert, picking up a meal from the local family-run restaurant, or hosting an intimate party with a few friends and family. Events like these are a great way to make memories and stay connected with one another, while also providing opportunities to support small businesses and help sustain the local economy.

Better yet, continue the movement beyond the holidays. Show support for entrepreneurs and small businesses throughout the year by shopping locally and encouraging your friends and neighbors to do the same. Post a picture or video of your favorite locally sourced product and share it on social media as inspiration for others.

To learn more about how New Tripoli Bank supports local small businesses and the community, you can listen to testimonials from our business customers and the nonprofits we support.

Kate Hart-Zayaitz is New Tripoli Bank's Chief Lending Officer and Senior Vice President. Kate has spent many years working for various community banks in our area. She was born and raised in Emmaus and has been involved with multiple banking and economic organizations throughout the Lehigh Valley.

Nobody likes tricks when it comes to banking. At New Tripoli Bank, we focus on the “treats” that distinguish us as your trusted bank.

We do business the old-fashioned way – one customer at a time - partnered with today’s conveniences like mobile/online banking. It’s been our philosophy since we opened the doors 112 years ago, and it continues to help us serve the unique needs of our customers today.

Community banks’ relationship focus has made us America’s favorite lenders according to a Federal Reserve small business credit survey, with approval ratings well ahead of those megabanks and online lenders.

It’s not just proximity that wins repeat business. Unlike credit unions and the Farm Credit System, New Tripoli Bank effectively serves both individuals of modest means and agricultural borrowers without taxpayer-funded subsidies.

We put our dollars to work right here in the Lehigh Valley, helping to support local school districts, fire departments, EMS departments, and other municipal services. New Tripoli Bank also helps fortify our community through philanthropic outreach and civic service. In 2021 alone, New Tripoli Bank donated over $200,000 to local aid organizations, fire departments, and historical societies.

Our employees volunteer to help in our community. They sit on the boards of the East Penn, Greater Lehigh Valley, and Western Lehigh Chambers of Commerce. Members of our organization volunteer with food banks, churches, youth sports associations, and emergency services all around the valley. For example, volunteers from the bank helped stock shelves at the Lowhill Food Pantry and others handed out free ice cream to patrons of Pioneer Apple Fest.

The treats don’t end there. Community banks have a strong track record of helping underserved Americans by providing greater flexibility to low-income and minority borrowers. It’s the community banking way. New Tripoli Bank is committed to providing community development loans that provide financing for the construction of affordable housing, non-profit organizations serving low-moderate income markets, local and state community development projects, and community revitalization efforts.

We won’t disguise tricks as treats or leave customers holding the bag during times of need. Our fates are linked, so when good things happen for you, New Tripoli Bank and our community win as well. That’s the community banking difference, and it’s pretty sweet.

Autumn is here and while the leaves and temperatures are falling, it seems like the price of food and gas aren't following suit. On top of that, the changing season means more reasons to spend money including increased utility bills, updating your winter wardrobe, and planning for holiday purchases. Here are some tips to help you rake in some savings this fall season.

Winter-proof your home. Some TLC in the fall goes a long way toward cutting down on winter utility bills. Consider improving your home insulation by caulking or using weather-stripping on windows and doors, and clean out your gutters to help with drainage. Cleaning or changing your furnace filter and checking if your roof is in need of repairs are two economical habits essential to prepare for the winter months. You should also consider switching to energy-efficient lightbulbs; though they cost more upfront, they'll save you money on electric bills in the long run.

Save on Appliances. Keep an eye out for your household appliances that are in need of replacing. Stores will put appliances on sale during the fall season to make room for new inventory and the latest models that come out just in time for holiday shopping. If you're shopping in person, ask sales associates if you can purchase floor models, which often come at a discount.

Clean Out Old Items. Take a long, hard look at your closets and storage spaces: they're probably full of items you haven't used in several years! Fall is a great time to clear out these items and make some additional cash while you're at it. Reach out to your neighbors about hosting a garage sale to sell off old, unwanted items, or post them to online shopping sites like eBay or Facebook marketplace. If you have a lot of old, still wearable apparel, clothing swaps are a great way to change up your wardrobe without spending a dime.

Set a Budget. Did you spend a little too freely over the summer? Fall is the perfect time to get your budget back in line. Go over your expenses and identify areas where you can cut back. With the holidays fast approaching, saving extra cash now means you'll have more in your pocket for holiday purchases. New Tripoli Bank's online banking tool makes it easy to track your spending and allows you to set up automated bill payments to make sticking to your budget simpler.

Embrace DIY. Before you spend money on autumn accessories or Halloween décor, tap into your inner artist! Fall is a great time for DIY projects which can be a fun, cost-effective activity to enjoy with your family.

Finding ways to be frugal this season can help you save money while allowing you to enjoy everything the fall season has to offer. The best way to get started with your savings goals is signing up for Free Checking with New Tripoli Bank, which gives you access to our online banking tools that make it easy to keep to a budget.

The wave of mail check fraud and mail theft continues to affect communities throughout Lehigh County. In a recent news release, PA state police asked for public assistance to identify a vehicle connected with multiple thefts from residential mailboxes. The latest thefts took place on the 5100 block of Arrowhead Drive in North Whitehall Township, where police report two men in a maroon sedan stole mail from a mailbox. State troopers then responded to a second theft in the 7900 block of Saegersville Road in Heidelberg Township, where men in a maroon sedan were seen stealing mail from a mailbox. Authorities have asked that anyone with information related to these thefts contact state police at Bethlehem at (610) 861-2026.

As always, New Tripoli Bank recommends customers take steps to protect their sensitive financial information from mail theft and mail check fraud:

- Set up online bill pay using our online or mobile banking tools, if you feel comfortable doing so. You can learn more about setting up automated bill pay here.

- If you want to continue mailing checks, we recommend you drop them off at your local Post Office or hand them directly to a USPS employee.

We also advise our customers write their checks out in gel or felt tip pen to help prevent the check from being altered. If you plan to use a blue mailbox to mail checks, try to deposit your checks around the time of the last mail collection of the day so the check does not sit in the mailbox for long.

If you have been a victim of a scam, whether it be check fraud or another scam, please reach out to New Tripoli Bank at 610-298-8811 and we can help you. You can also contact the U.S. Postal Inspection Service at 1-877-876-2455 or visit https://www.uspis.gov/report to file a report.

For more information on mail check fraud, you can watch our Helpful Hints video on the topic!

Log In

Log In

Log into Online Banking

Log into Online Banking