New Tripoli Bank donated $10,000 to the Cetronia Ambulance Corps in recognition of the important role this organization plays in the health of our community.

Cetronia Ambulance Corps is the largest community-based non-profit ambulance service in Eastern PA, answering more than 60,000 calls a year and providing 911 service to more than 100,000 residents. They also provide emergency response training and education programs.

New Tripoli Bank is a proud supporter of the Cetronia Ambulance Corps and urges support for this important non-profit organization.

Pictured from left to right: Bob Mateff, Cetronia Ambulance COO; Andrew Wirth, Paramedic; Keri Miller, Paramedic; Dave R. Hunsicker, New Tripoli Bank President & CEO; Larry Wiersch, Cetronia Ambulance CEO; John Hayes, New Tripoli Bank Executive Vice President & CLO; Zach Bath, EMT; Brandon Selig, EMT

As we say good-bye to the last decade and hello to 2020, it’s even more important to focus on planning for tomorrow. One of the best New Year’s resolutions you can make for yourself is to start establishing good credit habits and set financial wellness goals for yourself that will help you get back on the path to a prosperous financial future.

If personal finances are a house, then having good credit is the foundation. Whether your plan is to purchase a new home or start your own small business, you’ll need a loan to get there, and you won’t be able to get one without good credit!

Like anything in life, responsible credit practices are not something anyone is naturally good at. You have to work toward developing habits that demonstrate sound money management strategy. Remember; it’s much easier to build a credit score than repair a damaged one.

Enough introduction: what can you do to avoid costly missteps as you start on your journey to building and maintaining good credit?

- If you are just beginning to establish your credit history, open a checking account with your local community bank and make a habit out of keeping track of your balance. New Tripoli Bank has a free checking account to get you started and money management tools in our online banking platform.

- Instead of cash, use debit and credit cards for convenience and safety. However, make sure you don’t overspend! Missed or late payments can be damaging to your credit and will end up hurting your credit score.

- Try to maintain a varied mix of credit types (such as a revolving line of credit or an installment loan). Utilizing different types of credit shows your ability to manage your finances and will boost your credit score.

- Three to six months prior to making a major purchase, you should take extra care to demonstrate financial stability. Loan officers will feel more comfortable lending to you if you aren't opening and closing accounts or moving large amounts of money around, and avoiding these practices can mitigate stress after a large purchase.

- Build an emergency fund equal to at least six months of living expenses. That way, if the unexpected happens, you will still be able to pay fixed expenses without falling behind.

- As you reach different stages of life, you should alter your credit focus. Early in life you can take out loans on larger purchases such as automobiles and real estate, which will help you build credit, but as you near retirement you will want to make sure these major loans are paid down.

- Monitor your credit regularly to correct any errors and quickly detect signs of potential identity theft. Order a copy of your annual credit report from annualcreditreport.com. You can also sign up for credit monitoring services that will help protect your credit.

If you’re concerned about your credit or want help achieving financial milestones, you should contact your local community bank who is always ready to assist. Maintaining good spending and saving habits early can help you focus on your financial goals and make it easier for you to navigate life’s unexpected twists and turns.

New Tripoli Bank is happy to announce that Donna Sigley has been promoted to Vice President, Mortgage Loan Officer for New Tripoli Bank.

Donna has been interested in banking for most of her life. While attending Emmaus High School, Donna enrolled in night classes at Merchants Bank to learn more about the banking industry. Prior to joining New Tripoli Bank, Donna worked as a cashier in the cafeteria at Northwestern Lehigh, a position that afforded her more personal time to spend with her husband and raising their two sons. However, Donna’s interest in banking never went away. When her sons were old enough, she applied for a job at New Tripoli Bank (where she was a customer) and started employment as a teller in February, 2001. Within a year, she was also working as a loan processor. She was promoted to Mortgage Officer in 2007 and Assistant Vice President in 2013.

Donna says her favorite part of the job is the opportunity to help customers achieve their personal financial milestones, whether it’s their first car loan, first mortgage, or simply advising customers looking to build good credit. She’s thankful for the mentorship she received from the leadership at New Tripoli Bank and her coworkers in the loan department, all of whom she credits for helping her succeed as a loan officer with New Tripoli Bank.

Congratulations to Donna on her well-deserved promotion and for being such a vital part of the New Tripoli Bank family for the last 19 years.

We've all been on the receiving end of gift cards for the holidays. After all, they are a convenient present for when you're not sure what to get your friend or relative, but still need to get a gift for them.

Unfortunately, what should be something harmless can often be used by scammers as a way to defraud people out of their money. After all, a gift card is just like cash (i.e. any misuse is hard to trace) and, unlike credit cards, there usually aren't any resources customers can turn to when their gift card is stolen or used without authorization, so it is difficult to reverse a fraudulent transaction or get a refund.

Another common gift card scam occurs when someone poses as an attorney for a family member, claiming that family member is in legal trouble and needs help. The scammer will contact you via phone or email and ask you to purchase gift cards in specific amounts to pay them. Once you purchase these gift cards, the scammer will ask you to provide the card numbers and PINs so that the scammer can redeem the funds, leaving you out several hundred dollars.

Asking for gift cards to pay for legal issues and unexpected contact via phone or email are both big red flags that you might be the target of a scam. Remember: no business or government agency will ask you to make payments with gift cards. It's also a good rule of thumb to avoid making payments via phone or by wiring money, unless you can confirm the request is legitimate via other communications.

Also, be on the lookout for gift card scams when you're selling items. There is a common gift card scam that involves a person offering to purchase an item and sending you a check for more than the item's purchase price. They will then ask you to send back the difference in the form of a gift card. When you attempt to cash the check later, you will discover it is fake!

If you suspect you've been the victim of a gift card scam, you should report the situation to your local police department as well as notify the Federal Trade Commission (FTC), which tracks these scams. In addition, you should immediately report the scam to the merchant or company that issued your card and ask if they can refund your money. Most issuers have a toll-free telephone number to report lost or stolen cards, and you may get back the money left on the card or at least a portion of it (there is sometimes a fee for providing a refund). Be sure to keep the receipt and a record of the card number as you may need to provide this information when you report fraud.

Tips When Buying Gift Cards

Scammers asking for gift cards isn't the only way you can be defrauded. Here are some safety tips you should keep in mind when you're buying gift cards.

- Avoid buying gift cards from unfamiliar websites. You should only buy gift cards from sources you know and trust.

- If you are buying physical cards from a retailer, check before purchase. Sometimes criminals will scratch off the backs of the cards and steal the numbers and PIN.

- Read the fine print. Make sure you understand the terms and conditions. Check for an expiration date, fees to use the card, and fees for dormant cards.

- Register your card. This may help protect you in case the card is lost or stolen.

Wawa is notifying potentially impacted individuals about a data security incident that affected customer payment card information used at potentially all Wawa locations during a specific timeframe. Based on the investigation to date, the information is limited to payment card information, including debit and credit card numbers, expiration dates and cardholder names, but does not include PIN numbers or CVV2 numbers. The ATM cash machines in Wawa stores were not impacted by this incident. At this time, Wawa is not aware of any unauthorized use of any payment card information as a result of this incident.

Wawa’s information security team discovered malware on Wawa payment processing servers on December 10, 2019, and contained it by December 12, 2019. After discovering this malware, Wawa immediately engaged a leading external forensics firm and notified law enforcement. Based on Wawa’s forensic investigation, Wawa now understands that this malware began running at different points in time after March 4, 2019. Wawa took immediate steps after discovering this malware and believes it no longer poses a risk to customers.

“At Wawa, the people who come through our doors are not just customers, they are our friends and neighbors, and nothing is more important than honoring and protecting their trust,” said Chris Gheysens, Wawa CEO. “Once we discovered this malware, we immediately took steps to contain it and launched a forensics investigation so that we could share meaningful information with our customers. I want to reassure anyone impacted they will not be responsible for fraudulent charges related to this incident. To all our friends and neighbors, I apologize deeply for this incident.”

Wawa is supporting its customers by offering identity protection and credit monitoring services at no charge to them. Information about how to enroll can be found on the Wawa website below. Wawa has also established resources to answer customers’ questions, including a dedicated call center that can be reached at 1-844-386-9559, Monday through Friday, between 9:00 am and 9:00 pm Eastern Time or Saturday and Sunday between 11:00 am and 8:00 pm, excluding holidays.

New Tripoli Bank is also ready to support our customers who may have concerns about their account security. You can download our mobile banking app and set up push notifications to alert you when there is activity on your New Tripoli Bank accounts, so you will be notified immediately if there are any suspicious or fraudulent transactions made on your account. Take the time to update your passwords. If you think one of your cards has been compromised, you can deactivate your card by using our mobile banking or online banking tools or by calling our toll-free number at 888-298-8821 (during business hours), 800-264-5578 (after business hours) or 701-461-2552 (international) and requesting a new card.

A detailed notice and open letter to customers from Wawa’s CEO notifying potentially affected individuals about the incident is available at www.wawa.com/alerts/data-security

The holidays are a time for spreading cheer and giving gifts to friends and loved ones. When you’re looking for the perfect gift this holiday season, it can be tempting to default to the internet. However, this holiday season, you should consider picking up a one-of-a-kind gift from your local small business instead.

“Why is that?” you might be asking. After all, the internet has made it easier than ever to find that popular new toy—the one that would have sold out in holidays past—and have it delivered to your home, not by Santa but by the postal service. However, it’s only slightly more difficult to drive to a local independent business to do your holiday shopping and, more importantly, buying a gift from a local small business is also a gift to your community.

Every dollar spent at independent businesses is money that stays in your community. Studies show that when you shop at smaller retailers, those business owners will spend that money locally as well, keeping the money in your community for longer. Small businesses are also the leading job creators in the United States, accounting for two out of every three new jobs created annually. That means your dollar ensures those small mom-n-pop stores will have the money to expand, modernize, and remain in business!

Perhaps you’re concerned about our impact on the environment. If so, you should absolutely choose to patronize independent local businesses, which typically consume less land, carry more locally-made products, and create less traffic and air pollution by not having to ship products over long distances.

However, the most important reason to commit to shopping locally this holiday is simple: the creations you find at small local shops are one-of-a-kind, unique gifts that you won’t find anywhere else, more memorable than whatever the hot new must-have toy or tech gadget is this year. Here’s an example: do you remember Tickle-Me-Elmo? You had probably forgotten about it after the year it was the hot toy for Christmas and hadn’t thought about it until I mentioned it just now. While these mass-produce products are fleeting, a hand-painted statue or a quilt with your family’s names on it will create a lasting memory your friends and family can enjoy.

Your “gift” doesn’t necessarily need to be a product. It could be an experience, like going to see a local band, taking your friends out to a fancy dining experience at a local family-run restaurant, or something as simple as a holiday event with family featuring food, drink, and entertainment bought from small independent businesses in your community.

Whatever your holiday plans are this year, it’s important you show your support for entrepreneurs and small businesses by using your dollar locally. We should all work to spread the holiday cheer and ensure our local business community can thrive!

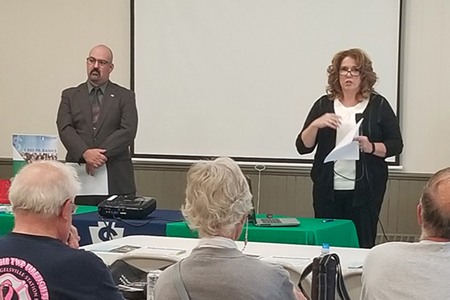

Jack Dasilva, New Tripoli Bank Vice President and Security/BSA Officer, and Sundra Bachman, New Tripoli Bank Vice President and Senior Branch Manager at the Buckeye office, discuss security topics.

Over the past three months, New Tripoli Bank hosted a series of free seminars in order to educate Lehigh Valley residents about the startling rise in incidents of scam and fraud in our community and what people can do to protect themselves. We invited customers and community members to join us at the New Tripoli and Buckeye offices, where bank employees and guest speakers discussed a wide range of security topics including elder abuse, cybersecurity, scams, and fraud schemes. Over 300 people showed up to these seminars to learn how they could protect themselves from identity theft or financial injury and engage in dialogue with experts on these issues.

Left to right: John Hayes, Executive VP & Chief Lending Officer, New Tripoli Bank; Dave Shallcross, Director, Senior Protection Unit, PA Attorney General's Office; Dave Hunsicker, Chairman, President & CEO, New Tripoli Bank; Jack Dasilva, Vice President, Security & BSA Officer, New Tripoli Bank

As a community bank, it is important that our customers trust us to keep their money and personal information safe. During these seminars, New Tripoli Bank employees including managers, tellers, and IT professionals discussed the signs of financial fraud and identity theft that our employees encounter on a regular basis and explained how our bank staff are trained to identify these scams, aiding customers who may unwittingly be in the midst of becoming a victim. In addition, we want to make it clear that, should anyone in our community—whether they are a customer or simply a concerned citizen—notice something suspicious or worry about protecting themselves, they should get in touch with our trained bank staff who are able to answer any questions or concerns you may have.

We also recorded the seminar held on September 25th at our Buckeye office and have uploaded these recordings to YouTube for anyone to view. If you are interested in protecting yourself from scams and fraud, you can view them here: https://www.youtube.com/playlist?list=PL7Hu2eOxbWd9ln_8Ijvut0G42TWSLRRKI

Left to right: Dave Shallcross from the PA Attorney General's Office discusses identity theft; Katrina Boyer from the PA Department of Banking & Securities discusses Cybersecurity; Jack Dasilva discusses identity theft and technology.

Tips for Secure Online Shopping

The internet has revolutionized the way we shop. You can search for items from many different sellers from the comfort of your living room, easily compare pricing between vendors, and purchase products with the click of a mouse. While this has made shopping easier than ever, it leaves you vulnerable to attackers attempting to steal your personal and financial information. Criminals who get a hold of sensitive data can use it for their personal gain, making purchases with your account or selling the information to the highest bidder, while negatively affecting your financial security.

How do criminals target consumers?

There are four methods criminals commonly use to take advantage of online shoppers:

- Target vulnerable computers – Hackers will try to gain access to your computer and all the data contained therein. That's why it's important to take steps to protect your personal computers from viruses or malicious code. This also applies to vendors handling sensitive information; they must protect any customer data stored on their business devices.

- Intercept financial transactions – If transaction information isn't encrypted at the point of sale, criminals may be able to intercept the information as it is being transmitted.

- Sending phishing emails – Scammers don't need to infect your computer with a virus or malware in order to gain access to personal information. Attackers will often send emails that appear to be legitimate in order to convince you to supply them with information.

- Creating fraudulent websites – Hackers have become very good at creating phony websites that look like official webpages in order to trick people into entering in personal information.

How can you protect yourself?

Now that you know the tactics attackers will use to gain access to your information, it's important to keep these tips in mind when shopping online:

- Be skeptical of emails asking for your personal information – You should never assume the legitimacy of any email that asks you to provide account information. Most businesses do not solicit account information or ask for purchase confirmations via email. A good rule of thumb: never provide sensitive information through email. If an email asks you to click a link, you should instead visit the company's website directly.

- Only do business with reputable vendors – Any time you visit a shopping site, you should verify that you're working with a reputable vendor. Always review the site certificate information (paying special attention to the "issued to" information) and take note of phone numbers and physical addresses in case there is a problem with your purchase or your bill.

- Use a credit card – Credit cards usually offer greater fraud protection than debit cards. Also, because they are not tied directly to your bank account, you'll still have access to your money in the event that you need to deactivate your card.

- Make sure your information is encrypted – If a site is using a secure, encrypted connection, the URL will begin with "https" instead of "http" and your address bar will show a locked padlock icon like this 🔒. Some attackers will use a fake padlock icon on the website itself; you want to make sure the icon appears in your browser's address bar.

- Check your shopping app's settings – Be careful when using an app to shop. There is no legal limit on your liability for funds stored on a shopping app or gift card.

- Check your statements – Keep a record of any purchases you make online and compare them with your regular financial statements. Any discrepancies should immediately be reported to your financial institution.

- Read the vendor's privacy policy – You should always be aware of how your sensitive data is being used before you provide a seller with any personal or financial information.

New Tripoli Bank has donated $25,000 to the East Penn School District Education Foundation as part of an ongoing effort to support public education in our community.

This donation will go toward refurbishing the Macungie and Wescosville Elementary School libraries to improve the overall function of library spaces. The EPSD Education Foundation plans to utilize the donated funds to design spaces that promote problem solving, innovation, project-based learning, student choice, and flexibility.

New Tripoli Bank is a proud supporter of education and this donation ensures our local school district can provide their students with modern technology and equipment that will enhance their learning experience and prepare them for success in the future.

From left to right: Dave Hunsicker, New Tripoli Bank President, Chairman & CEO; Michele Hunsicker, New Tripoli Bank Executive Vice President & CFO; John Hayes, Executive Vice President & Chief Lending Officer; Sal Verrastro, ESPD Education Foundation President; John Zayaitz, EPSD Education Foundation Vice President; Chris DeFrain, EPSD Education Foundation Secretary; Kristen Campbell, EPSD Superintendent; John Hemak, EPSD Education Foundation Treasurer & New Tripoli Bank Assistant Vice President & Commercial Lender

One of the descriptors most commonly attributed to millennials is "tech-savvy." Coming of age in the late 90's and early 00's, during the Information Age and the rise of social media, we think of millennials as "plugged in" and exceptionally cognizant of how to navigate the internet. Consequently, one would assume millennials are skilled at avoiding the pitfalls of an increasingly connected world.

However, millennials are just as vulnerable to scams as previous generations. In fact, millennials are twice as likely as people 40 or older to report losing money while shopping online and 77% more likely to report losing money to an email scam. Even more worrying, Generation Y is 93% more likely than people age 40 or older to fall victim to fake check scams. According to the FTC, millennials reported losing nearly $450 million to fraud since 2017, with $71 million the result of online shopping scams alone.

The basics of these fraud schemes are familiar, but utilize new technology in ways that make them more difficult to recognize. Here are some schemes that scammers are using and how you can avoid becoming a victim:

Fake Employment Offers

Finding a job can be stressful and many millennials are willing to look past some red flags if it means landing a well-paying job. Here's how it works: the scammer will offer a position to their target, often with great pay, then send them a fake cashier's check to purchase equipment needed for the job. The best way to avoid these types of scams: if you're sent a large check from someone you don't know well, always check with the financial institution on any check you cash to make sure the check is real.

Device Activation Scams

Millennials are the generation of smart phones, iPads, and Alexa. Scammers know this, which is why one of the most common scams involves sending an email alerting the consumer of an activation fee for their new device. The scammer includes a fake customer support number or creates a fake website that looks like the actual product website, where the consumer is asked to provide credit card and device information to pay the activation fee. Not only does this give the scammer access to your device, it will also give them access to your identity.

The best way to avoid this: most devices don't require an activation fee! Device activation is usually handled at the point of sale, rather than in a follow-up email. If you're still unsure (or if you receive a suspicious email asking you to call a customer support number or visit a website to enter personal information in general), you should visit the manufacturer's website directly instead of clicking any links or calling numbers in suspicious emails.

Social Media Scams

It is true that millennials are much better at avoiding scams that involve phone and email. However, when the same scams are attempted through social media, 53% of consumers report having lost money to fraud. Because we share so much on social media, scammers are better able to find vulnerable consumers, such as those who are lonely or recently experienced a loss, or younger adults feeling financial pressure. Always be skeptical of offers made through social media, doubly so if you don't know the person contacting you.

Social media can actually help you avoid these scams; if you suspect a scam, search social media to see if others have encountered something similar. People often post warnings about scams after they've become victims. While the internet has provided scammers increased access to consumers, it has also given consumers access to knowledge to fight back against fraud.

Next Page »« Previous Page

Log In

Log In

Log into Online Banking

Log into Online Banking